It is essential to maintain a good CIBIL score as a higher score increases the chances of loan approvals and helps individuals negotiate better interest rates and credit terms. Regularly checking your credit report and working on improving your credit behavior can positively influence your CIBIL score over time.

What is CIBIL Score

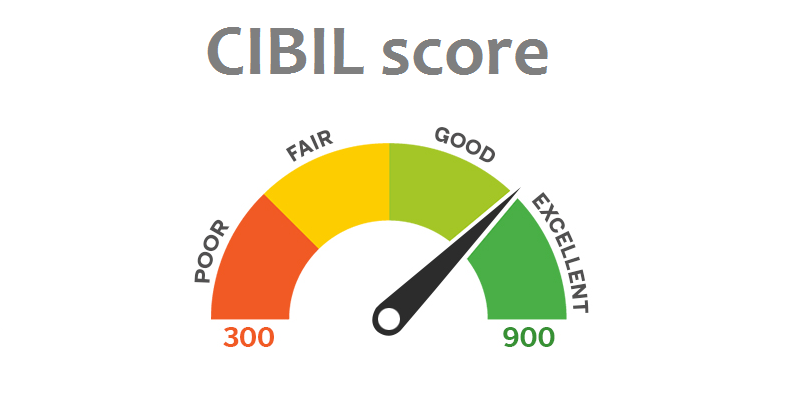

CIBIL score (Credit Information Bureau India Limited) is a numerical representation of an individual’s creditworthiness, based on their credit history. In India, it is commonly used by lenders, such as banks and financial institutions, to assess the credit risk associated with potential borrowers before approving loans or credit cards.

Also Read: Programming languages used in various tech giants

The CIBIL score ranges from 300 to 900, with a higher score indicating a better credit profile and a lower risk for lenders. The score is calculated by taking into account various factors, including:

- Credit Payment History: Timely payment of credit card bills and loan EMIs is crucial to maintain a good credit score.

- Credit Utilization: The percentage of the credit limit used on credit cards. Lower credit utilization is considered favorable for credit scores.

- Credit Mix: A healthy mix of secured and unsecured credit, such as loans and credit cards, may positively impact the score.

- Credit History Length: A more extended credit history can be beneficial, as it provides more data for evaluating creditworthiness.

- Recent Credit Inquiries: Multiple credit inquiries within a short period may negatively impact the score, as it can indicate higher credit risk.

- Defaults and Delinquencies: Instances of late payments, defaults, or loan settlements can significantly lower the CIBIL score.

Here’s how you can check your CIBIL score through the official CIBIL website:

- Open your web browser and go to the official CIBIL website (www.cibil.com).

- Click on the “Get Your CIBIL Score” or “Check your CIBIL Score” button.

- You will be directed to a page where you must provide your personal information, such as name, date of birth, address, contact number, and identification details.

- After providing the necessary information, you may be required to go through an authentication process to verify your identity.

- Once the authentication process is complete, you will be able to view your CIBIL score and credit report.

Keep in mind that there may be some fees associated with obtaining your CIBIL score and report, depending on the provider and the specific services you opt for.

Also Read: Book train ticket using Google Pay

How to check CIBILscore in Google Pay?

Google Pay offered a feature to check the CIBIL score for free. However, it is important to note that services and features of apps might change over time, so it’s always a good idea to verify the steps with the most recent version of the Google Pay app.

To check the CIBIL score on Google Pay, follow these steps:

- Open the Google Pay app on your mobile phone.

- Tap on the “Manage your money” tab, which is usually located at the bottom of the screen.

- Scroll down the list of options and look for “Check your CIBIL score for free” and tap on it.

- You will be prompted to enter your first name and last name as they appear on your PAN card.

- Tap on “Continue” after providing the required details.

- Google Pay will ask you to verify your identity for security purposes. You can do this by entering your mobile number or email address associated with your Google Pay account.

- Once you have verified your identity, your CIBIL score will be displayed on the screen.

Please note that while Google Pay may offer a free CIBIL score check, obtaining your credit report from the official credit bureaus like CIBIL, Equifax, or Experian directly is also possible, and you are entitled to one free credit report annually from each of these bureaus as per the Reserve Bank of India (RBI) guidelines. It is a good practice to monitor your credit report regularly to understand your creditworthiness and take necessary steps to improve your credit score if needed.

You might also like our TUTEZONE section which contains exclusive tutorials on how you can make your life simpler using technology.